Frequently Asked Questions

What is an ATM?

An ATM (Automated Teller Machine) is a self-service device that enables customers to withdraw cash, check balances, and complete other basic banking functions using a debit or ATM card.

How do ATMs work?

ATMs connect to your bank or financial network electronically to authorize transactions. When a customer withdraws cash, the ATM verifies the card details, checks the account balance, and dispenses funds if approved.

Which ATM brand is best?

The right ATM brand depends on your business needs. Ocean ATM offers several reputable brands like Genmega, Nautilus Hyosung, Triton and Hantle — each known for reliability, compliance, and supportability for business owners.

ATM Placement & Business Use

What is ATM placement for businesses?

ATM placement is a program where Ocean ATM installs and manages an ATM at your business location. We handle installation, processing, monitoring, and support, while you earn a share of the surcharge revenue generated by customer transactions.

Is ATM placement really free?

In many cases, yes. Ocean ATM often places ATMs at qualified locations with no upfront cost for the equipment or installation. Approval is based on factors like foot traffic, transaction potential, and location type.

How much money can a business make from an ATM?

Earnings vary by location, foot traffic, and customer usage, but many businesses earn several hundred to over a thousand dollars per month from surcharge revenue.

Who loads the cash into the ATM?

Cash loading depends on your model. Some businesses load their own cash; others arrange professional cash loading. Ocean ATM can review your needs and recommend the best cash management solution.

Do I need a bank account for an ATM?

Yes. A business bank account is required to properly settle and reconcile ATM transactions. Ocean ATM assists with account setup and processing integration.

How long does ATM installation take?

After approval and completed paperwork, most ATM placements can be installed within 7–14 business days, depending on machine availability and site readiness.

Can any business qualify for ATM placement?

Qualifying depends on foot traffic, customer demographics, and transaction potential. Retail stores, bars, restaurants, convenience stores, and cannabis dispensaries are often good candidates.

Buying & Owning an ATM

Do you sell new and refurbished ATMs?

Yes. Ocean ATM offers both new and refurbished ATM machines for purchase. We help with selection, configuration, and setup based on your business needs.

What’s the difference between placement and ownership?

-

Placement: Ocean ATM typically owns the machine, installs it for you, and you earn revenue share.

-

Ownership: You purchase and own the ATM, retain all surcharge revenue less processing fees, and may manage cash and servicing responsibilities.

Ocean ATM can help determine which option maximizes your profits and operational ease.

Processing & Technical Support

Do you provide ATM processing services?

Yes. We offer full ATM processing, including transaction routing, reconciliation reporting, settlement, and technical support for both placed and owned machines.

Are your ATMs compliance-ready?

Yes. All equipment and services meet current industry standards including PCI compliance, EPP encryption, and network requirements to keep your ATM secure and operational.

Do you offer ATM service and repair?

Yes. Ocean ATM provides ongoing service, technical support, and troubleshooting to ensure your ATM runs reliably with minimal downtime.

What if my ATM runs out of cash?

If your ATM runs out of cash, we offer monitoring and alerts to help you refill quickly, reducing lost transaction opportunities and earning potential.

How Does The Settlement Process Work?

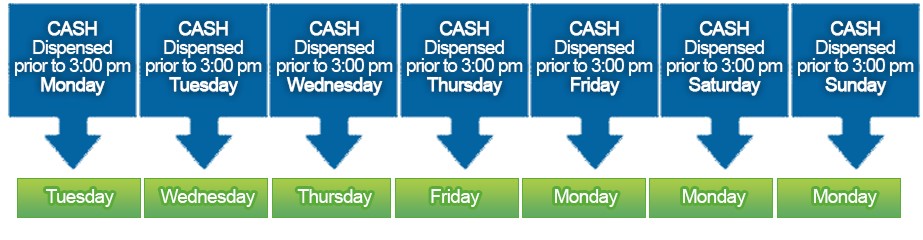

Settlement Chart

How Do I Balance My Machine?

In order to balance your machine, please obtain the following information before you attempt to balance:

- Number of bills you entered into the machine at the last fill

- Amount that has been deposited into the bank since last fill

- Amount of bills remaining in the machine (you can get this by pulling Cassette Total).

To balance machine:

Once you have this information, add the amount of money that has been deposited into your ATM account to the amount of money remaining in your machine (including tested and rejected bills). This number should equal your last fill amount. If it does not match, there are a few reasons this may happen:If the machine is short money:

- The machine may have money pending for deposit. This means that there may have been transactions that occurred after the last deposit into your ATM Account. To find out if this is the case, you can check the real-time transactions on your ATM Login.

- Confirm the amount of bills entered at last fill. You may do this by reviewing your receipts from your last fill.

If the machine is over money:

If there was a malfunction at the machine during a transaction, the machine may be over. In this scenario, the ATM charged the cardholder for the transaction and attempted withdraw, then deposited the money into your ATM account. If this happens the customer may dispute the transaction. If the transaction is disputed, we will contact you to get the information from the machine and to determine the reason for the malfunction.

Location & Service Area

Where do you provide service?

Ocean ATM services businesses throughout New Jersey and surrounding regions. We also service most areas in the Continental US. If you’re unsure whether your location qualifies, contact us to discuss your address and business type.

Do ATMs still make sense in a digital payment world?

Yes. Even with digital payment growth, cash is still widely used in many businesses. ATMs increase foot traffic, improve customer satisfaction, and create a secondary revenue stream for business owners.

Getting Started

How do I get started with ATM placement or sales?

Reach out to Ocean ATM at 877-538-2860 x1060 or via our online form. We’ll review your business type and location, explain your options, and help you choose the best ATM solution — whether placement or purchase — to fit your needs.

Our current top-selling ATM is the Genmega G2500 ATM, which is currently on sale for $2299 using online coupon code 100OFF at checkout.

You can also shop for other new ATMs to purchase here.

(877) 538-2860

(877) 538-2860