|

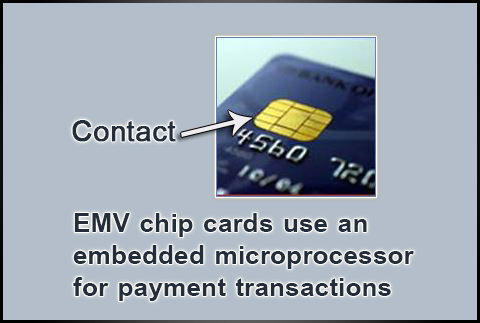

Click Here for EMV Upgrade kits What is EMV and Why is it Important? EMV Is A Set Of Specifications Defined By Europay International, MasterCard Worldwide, And Visa To Define Interoperability Standards For Smart Card Transactions. The EMV Specifications Were First Published In 1996. The Key Objectives Of EMV Are To Reduce Counterfeiting And Fraudulent Transactions And To Standardize All Payment Solutions On A Singular Specification Recognized Around The Globe. Commonly Used Globally In Place Of Magnetic Stripe, EMV Chip Technology Reduces Card Fraud In A Face-To-Face Card-Present Environment; Provides Global Interoperability; And Enables Safer And Smarter Transactions Cross Cards And Contactless Channels.

American Express, Discover, MasterCard And Visa Have All Announced Their Plans For Supporting An EMV-Based Payments Infrastructure In The U.S., With Acquirer Processor Readiness Mandates To Support Chip Data In Place For 2013, And Liability Shifts For Managing Fraud Risk In A Face-To-Face Environment Set For 2015. EMV Is Designed To Significantly Improve ATM Security For Consumer Card Payments By Providing And Enabling Features For Reducing Losses That Result From Counterfeit And Lost And Stolen Cards. EMV Also Offers A Worldwide Technology Standard For Chip- Based Financial Transactions And Services. Globally, 36% Of Total Cards, And 65% Of Total Terminals Deployed Are Based On The EMV Standard. France Was The First To Pilot And Implement EMV And They Have Seen More Than An 80% Reduction In Fraud Since The First Launch. Fraud Always Migrates To The Weakest Link And In Each Region Where EMV Has Been Adopted, ATM Fraud Has Dropped Dramatically. The Data Is Indisputable: EMV Is More Secure Than Mag Stripe. As Countries Continue To Migrate To EMV, Fraud And Counterfeiting Activities Shift To Less Secure Places, Such As The United States. The Good News Is That EMV Is Coming Soon To US ATMs And POS Terminals. But “Soon” Is A Subjective Term. Most Industry Experts Agree The Primary Driver For EMV Migration In The U.S. Will Come From Issuers, As They’re The Ones Tasked With Replacing More Than A Billion Mag-Stripe Credit And Debit Cards. This Won’t Be A Singular Event – But Rather An Ongoing Process, Where Expired Cards Will Be Gradually Replaced With EMV Cards. The Shift Will Be Subtle, And The Cardholder May Not Even Be Aware Of The Change. While The Deadlines For Compliance In The U.S. Continue To Shift, The Message Is Clear: It’s Time to Get Ready For EMV at the ATM

You Should Be Aware Of Deadline Dates And Available Upgrade Paths For Your ATM. In Most Cases, An EMV Card Reader And Updated Software Will Be Necessary. If Your ATM Is An Older Machine, There’s A Possibility That There May Not Be An Upgrade Path And It May Be Time To Replace It Altogether With A New ATM That Comes EMV Ready With An EMV Card Reader. If This Is The Case, We Will Work With You To Make The Upgrade As Painless As Possible With Flexible Purchase Options. If You Have Any Questions Or Concerns, Please Give Us A Call Directly At 732-899-9009

|

Google Rating

4.8

4.8

Erika D

17:08 23 Oct 25

I highly recommend Ocean ATM! Todd and Mike were extremely helpful getting our atm up and running. They guided me every step of the way, were detailed in the steps and patient. Thank you!

Evans Kakpovi

12:37 16 Oct 25

Delivered a well packaged machine, and provided setup instructions that made getting started easy!

Olivia Hoàng

03:18 15 Jun 25

Ocean ATM is a great team. We never have any issues since we've been their customer. Highly recommend 👌 everyone is so nice and friendly . We're so lucky to have them.

Landon Ford

13:37 06 Oct 23

I would have to say I was hesitant at first to begin this but Todd and the rest of the company were super helpful and were eager to answer any questions that I had. The ATM I bought is running smoothy, and the programs they set me up with work wonders. I don't think I would have been able to figure it out if it wasn't for the help of Ocean ATM. If you're a beginner like myself looking to get into the ATM business I would definitely considering using this company.

Karder Gollin

16:08 14 Sep 23

I was skeptical walking into a new business model and choosing the right company to work with. After purchasing my first machine and asking Todd many questions, he was very helpful, friendly, and quick to respond to my emails. I just purchased my second machine and highly recommend Ocean ATM to anyone looking to get into the business. Also having the peace of mind with the lifetime warranty they offer, no other company can beat them!

Taylor Newnam

11:59 13 Jul 23

I received quotes from several companies. Oceans ATM had the best pricing on the ATM and the processing and they were great at answering all the questions I had before and after my purchase. I highly recommend this company.

Evan Nelson

00:45 15 Jun 23

Todd and the rest of the ocean atm team has been amazing to work with. I owe my atm success to todd and the the team. If you ever plan on starting a atm business, this is by far the company you will want to go with.

Wilfredo Reyes

01:20 18 Jan 23

Purchased two ATMS in the span of 2.5 weeks. Everything from communication down to logistics were very smooth. Received my ATMs programmed and ready to go. I will continue to do business with Ocean ATMs. - R&R QUICK-BILLS

Jamie Tramjk

19:15 17 Jan 23

Very professional team. Easy to purchase an atm for your business or start your own business

Vaia K

14:46 13 Dec 22

Todd and the rest of the company always provide the best service and assistance. He is always available to answer any questions we have. Thank you!

George Courtney

16:34 23 Jul 20

Todd at Ocean ATM provided us with a 5 star experience through and through. Not only was the price the best around, but the service was nothing less than extremely professional. We will be using his company again in the near future. A+!

M L

18:29 08 Jul 20

Best customer service and professionalism. Todd and Joe have always been very nice, answered all of my questions and helped me whenever I needed it. Started my ATM business in 2016 and Todd answered all of my questions and whenever I ran into trouble Joe helped me out. Everyone else has also been nice too but I dont remember their names. If you need any products go with Ocean ATM, you won't regret it. I'm in the CA and always got my products without any problem.

gina bar

20:19 02 Jul 20

Top notch - always. I've dealt with Todd on several occasions and the service he provides is exceptional. Thank you so much, and please keep up the good work!

Michael Trusty

17:27 25 Nov 19

Thanks to Ocean ATM and Todd (sales) for helping me navigate thru purchasing and running our first ATM. The set up process went exceptionally smooth and any questions were answered promptly. We were able to be up and operational within a couple weeks without hesitation. Would highly recommend!

hoshino ryuichi

16:11 21 Sep 19

Very nice It is highly recommended to buy ATM here. My English is not very good. They are very patient.

Esteban Munne

18:07 30 May 19

Excellent service by Todd and Ocean ATM support 24/7. Pricing and products are very competitive. Fast shipping and delivery with machine already programmed and ready to use made the switch easy. Highly recommend Ocean ATM.

John Bartlett

15:58 27 Feb 19

Started our experience with Ocean ATM last April with our first machine. From day one Todd, Dana and Joe have been great to work with! They have patiently educated us as well as provided excellent tech support service for us being novices. They always answer the phone or get back to you timely. In ten short months we now have three ATM’s and no plans to use any other company than Ocean ATM!

chris wrenn

21:03 07 Feb 19

Being new to the ATM business, I found Todd and his team extremely helpful. They answered all of my questions promptly and have turned me into an ATM pro in a few hours. Thanks to the OceanATM team I now have a new stream of revenue flowing into our business.

Peter Passarella

14:09 07 Feb 19

I’ve been using Ocean ATM for 7+ years. New to the ATM business, they have made it seamless. Tech support is always very quick to respond, and from when we purchased the ATM to date, Todd Schager has always been there to help with any questions or needs.

Jon Singer

22:16 10 Jan 19

I’ve been using Ocean atm for about a year now. Gradually building an ATM business. They’ve made it a very easy process. Tech support has been great. I would, especially like to thank Todd Shager. He’s helped me every step of the way. Great going.

naim thabata

20:52 10 Jan 19

5 star for ocean atm, best company to deal with.

and specially a person name todd he was so help ful. we done the everything in 2 days even got my atm in 5 days. thanks todd

steve nguyen

17:54 17 Dec 18

ATM contract aggreement fairly. Great service. Smooth trnsaction. No problem. Highly recommend. Great Company. Thanks Todd for your outstanding business......

Carlos Graterol

00:48 15 Dec 18

My fiancé and I were looking into getting in the atm business as an extra passive income, it’s not really easy to invest your money and trust every process you hear about to make an extra income, But I can definitely say that Todd Shagger at Ocean ATM was my best guide and gave me that confidence I was missing, he followed up with us day after day while our ATM was in transit and even after we received it, he has always been available if any doubts come to mind, best I’ve seen in years, we also would like to thank Dana for helping us set up the ATM she was Amazing!!!!

Andre Mayberry

19:06 14 Dec 18

For my first ATM being set up everything went and is still going great. Tod assisted me with all my questions including before after installation and errors I’ve had. Looking forward to expanding in the future.

Filipe Monteiro

17:32 13 Nov 18

Todd was extremely helpful throughout the entire process. Great communication between the both of us.

nghia le

18:33 07 Jun 18

Ocean ATM is great, Todd has been very helpful and quick on responsiveness. Definitely recommend to anyone who needs Atm.

aziz darediya

17:03 05 Jun 18

I recently purchased an ATM machine from Ocean ATM Todd was the person of my contact he provided me with an excellent customer service support and gave me in-depth knowledge about why should I purchase ATM from them I was looking to different places but after talking to him and the supporthe provided me I was very please I will in touch with him definitely for my future. Thanks for your help Todd.

Aziz.

John Taormino

19:43 31 May 18

I could not have asked for better help and customer service. Todd and Dana both helped me in purchasing, setting up and getting our first ATM up and running. Todd made the hole experience very smooth and painless. I have recommended several people to Ocean ATM. Thanks again for helping me get an ATM.

Rafael

21:02 25 May 18

i had an awesome experience with Todd, Joe and Dana at Ocean ATM, while purchasing my first ATM . Very Helpful and Reliable!!

Just want to add I just purchased my second ATM and can’t be anymore pleased with the service provided by Todd Schager and the whole team.

diptesh patel

18:48 24 May 18

It was a pleasure working with Todd at Ocean ATM. Being a new customer without any knowledge of ATM business, Todd really took his time and explained how everything works. The gentleman who came to install was very polite and professional. Thank you for everything.

Rafael Almonte

02:45 24 May 18

Its been a pleasure doing business with Ocean Atm, looking forward to doing more business with you guys. And thank you Todd for responding to me breifly when I have questions to be answered.

Himanshu Rajgor

18:31 23 May 18

I have had ATM installed at four locations and never had an issue with service or sales. Everyone’s great to deal with.

Anthony John

15:15 12 Feb 18

I've been working with these good folks for years. No issues, very kind and professional.

John Floyd

15:54 08 Feb 18

We just got two units. The staff was super helpful from purchase to setup. I highly recommend Ocean ATM to anyone looking to start your own business or take control of your ATM in your existing business. These are the guys you need to talk to!

Dana International

20:04 16 Oct 17

I have Alex’s Barber Shop in Queens. I bought new ATM and got good service and good deal by Todd and Bobb . Very nice guys!

Mark Weatherbee

15:25 12 Oct 17

I have helped my girlfriend start an ATM business. We found Ocean ATM online and decided to use their services. Todd Schager walked us through everything and made the setup of this new venture a breeze. We cannot say enough about the other Ocean ATM employees as well! They are all amazing. We look forward to growing together.

jaymin patel

20:58 10 Oct 17

Best Service i have received from Todd from Ocean ATM thank u so much for helping me out

Peter Stevens

17:32 10 Oct 17

The guys at Ocean ATM are very helpful. The ATM setup was quick and easy. Great service.

Oscar Marmolejos

19:48 31 Aug 17

they are very helpful, love the way they help customers will recommend 100%

Shine Ventures LLC

23:58 15 Aug 17

Incredible service! Todd is readily available to help, pleasant to deal with, and quick to answer questions. He went above and beyond and was a true pleasure to work with. Joe was excellent during the installation process and made the process simple. He was patient and did an excellent job guiding me through the process. I highly recommend Ocean ATM and I can't imagine using any other company.

Dave Sekhon

19:04 06 Jun 17

Thank you, Todd and Ocean ATM! You have been very attentive and helpful with setting up an ATM in my business!

ann chapin

20:19 21 Apr 17

Ocean ATM and Todd have absolutely been fantastic to work with! From my initial query about a new ATM, through delivery and setup, they have been extremely helpful. I have never worked with a business that has been so responsive! I highly recommend them for all your ATM needs

Elieris Jimenez

18:23 10 Apr 17

Very pleased with Todd from Ocean ATM. I have a very busy schedule and he was able to work with me on my time. The process was also very smooth and got my ATM promptly. Specialist Joe was also very helpful assisting with the software installation and getting my ATM up and running. 5 Star for Ocean ATM. Thanks guys!

Sunrise Capital

14:46 15 Jan 16

I recently began doing business with Ocean ATM, and the entire experience has been trouble-free and professional, thus far. Todd and Mike are both great representatives of Ocean ATM’s quality of service. They completed the installation of two ATM machines for me today: the Nautilus Halo II and the 4000W. Mike was helpful and knowledgeable. I asked him many questions, and he answered every question with as much detail as the first. During the installation of the 4000W, Mike went to the hardware store on his own time because he noticed the machine would need a few extra bolts to be securely mounted. Todd was also willing to help and accommodating. He is the one who I initially spoke to about the machines, and he was happy to schedule a meeting that worked best for my schedule. I recommend Ocean ATM.

ANIK Services

18:17 03 Dec 15

Starter Business: Thanks to Todd(Sales) and Mike(Service Manager) I will continue to work with Ocean ATM for future business. Todd really went out of the way and worked with me to get my business started. Mike did an exceptional job installing the ATM and walking me through the different features as well as troubleshooting. Starting a business can definitely be intimidating however because of Todd's consistency and knowledge I felt reassured and the process was streamlined to meet my new businesses needs.

(877) 538-2860

(877) 538-2860